Corporate With Former LHDN Officer With Customize Tax audit & Investigation Services.

Stay compliant, Avoid Risks, Reduce costs

Elevate your business to New Heights

Tax Audit & Investigation

Tax Audit & Investigation Services at MyHasil help businesses handle LHDN tax reviews and investigations efficiently. The service includes reviewing tax records, identifying compliance risks, and providing professional support throughout the process to minimize penalties and ensure full compliance with Malaysian tax laws.

Stay Compliant

Meet LHDN and tax law requirements confidently.

Avoid Penalties

Detect and fix tax issues before they become costly.

Build Credibility

Strengthen trust with authorities and stakeholders.

Reduce Risks

Handle audits and investigations smoothly.

Improve Efficiency

Gain insights to enhance tax planning and compliance.

How We Work Together

Seamless white-label support to enhance your firm’s capabilities — providing expert service under your brand, while ex-LHDN specialists handle complex cases without the overhead of hiring specialized staff.

One Stop Tax Services

Pre

Pre

01

Pre-Audit Support for Your Clients

- Risk Assessment Outsourcing: We conduct detailed reviews of your client’s tax returns and records to identify red flags before LHDN does

- Audit Simulation Services: Provide your firm with comprehensive audit scenario reports based on real LHDN enforcement patterns

- Documentation Preparation: Prepare audit-ready documentation packages for your clients, reducing response time by up to 60% Preventive Strategy Reports: Deliver actionable recommendations to reduce your client’s audit exposure by up to 40%

02

Voluntary Disclosure Program (VDP) Support

- VDP Preparation Services: Complete preparation and submission support for client voluntary disclosures

- Qualification Assessment: Help your firm determine client eligibility for 100% penalty waivers

- Fast-Track Resolution: Support resolution of legacy tax issues within 2–4 weeks in most cases

- Risk-Free Regularization: Provide safe pathways for clients with undeclared income or past discrepancies

03

Strategic Tax Planning Collaboration

- Advanced Planning Support: Design tax structures that reduce client tax burden by 10–20%

- Incentive Optimization: Identify and implement sector-specific incentives and exemptions

- Proactive Strategy Development: Create forward-thinking tax strategies aligned with client business goals

- Compliance Future-Proofing: Prepare clients for e-Invoicing, SST 2.0, and upcoming regulatory changes

During

During

04

Audit Representation Partnership

- Co-representation Support: Our ex-LHDN officers work alongside your team during client meetings with LHDN

- Strategic Guidance: Provide your firm with insider knowledge on how to manage sensitive disclosures and communications

- Documentation Strategy: Help your team prepare and present client documentation in the most favorable light

- Penalty Reduction Techniques: Share proven strategies that have achieved significant penalty reductions for accounting firm clients

05

Investigation Crisis Support

- Emergency Response Team: Provide immediate support when your clients face field audits or surprise investigations

- Communication Management: Guide your firm through critical documentation and LHDN communications

- Business Continuity Planning: Ensure 90% of your clients maintain normal operations during investigation periods

- Legal-Tax Defense Coordination: Reduce criminal exposure and reputational harm through coordinated defense strategies

Post

Post

06

Post-Audit Resolution Support

- Appeal Preparation: Draft and review appeals and settlement negotiations on behalf of your clients

- Implementation Guidance: Provide your firm with detailed compliance improvement plans for client implementation

- Risk Mitigation Strategies: Deliver solutions that reduce future audit risks by over 50%

- Closure Management: Ensure proper resolution and long-term compliance alignment

Why Collaborate with Us?

Collaborating with MyHasil gives your business access to expert tax, accounting, and audit services in Malaysia. Our team ensures full LHDN compliance, accurate reporting, and strategic guidance that helps businesses operate efficiently and confidently.

Expand Service Offerings

without hiring specialized staff or increasing overhead costs

Enhance Client Retention

by providing premium audit defense and investigation support

Increase Revenue Streams

through value-added tax advisory and planning services

Build Market Reputation

as the firm with insider LHDN knowledge and proven results

Reduce Professional Risk

with expert backup during complex audit situations

Improve Client Outcomes

through faster resolutions and reduced penalties

Access Specialized Knowledge

on-demand without full-time employment commitments

Scale Premium Services

to meet growing client needs in today's complex tax environment

Our Services is Coverages All Industries

Construction & Property Development

Improper revenue recognition and JV-related structures can lead to costly tax disputes in property projects. With structured audit simulations and documentation strategies, complex project flows are clarified and positioned correctly — minimizing tax exposure and ensuring smoother cash flow.

Our Services is Coverages All Industries

Trading & Wholesale

Inconsistent stock records and overstated costs often trigger LHDN audits in trading businesses. By conducting in-depth risk reviews and preparing audit-ready documentation, our specialists help resolve these red flags early — reducing penalties and protecting profit margins.

Construction & Property Development

Improper revenue recognition and JV-related structures can lead to costly tax disputes in property projects. With structured audit simulations and documentation strategies, complex project flows are clarified and positioned correctly — minimizing tax exposure and ensuring smoother cash flow.

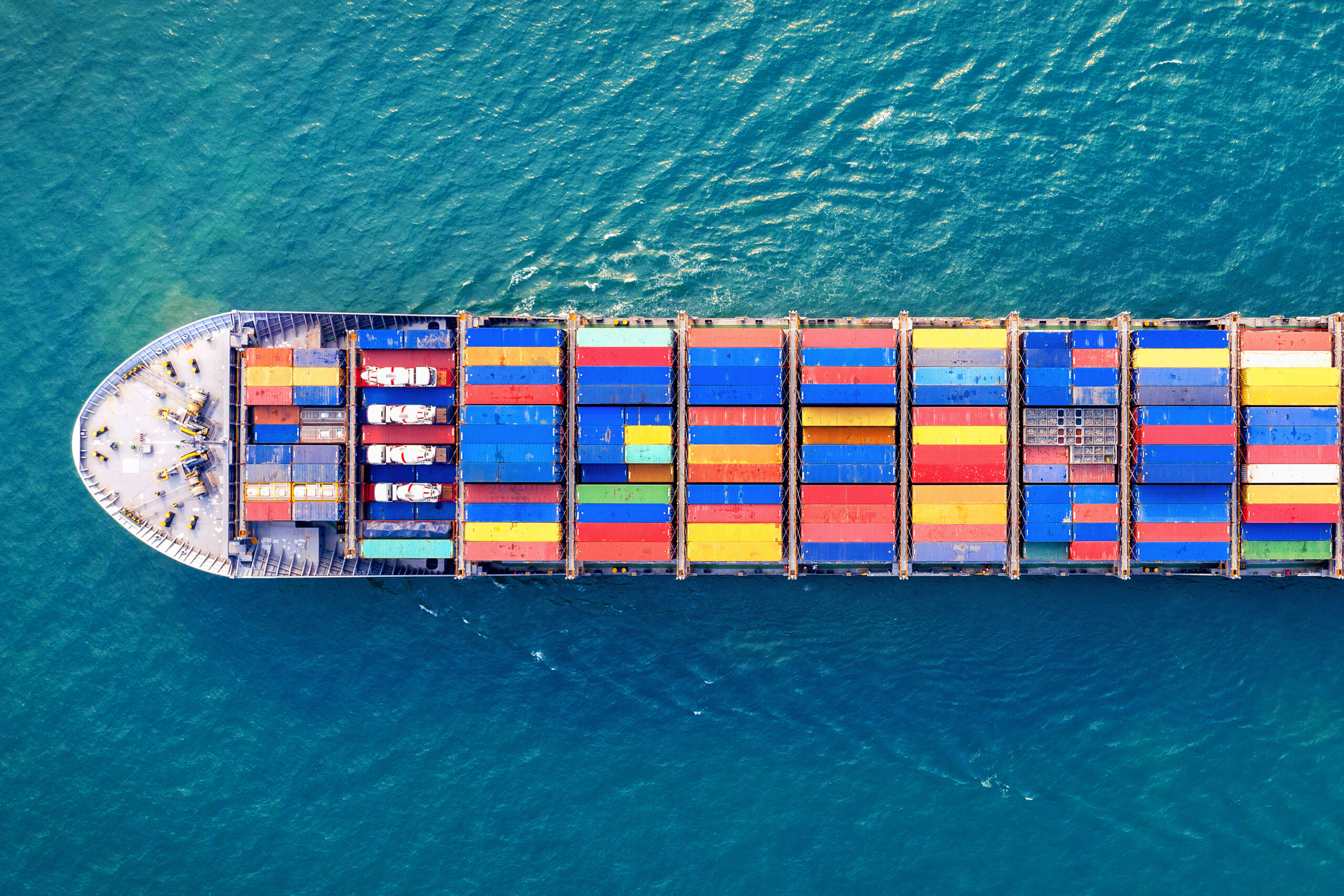

Logistics & Freight

Cross-border transactions and unclear commission structures frequently raise audit concerns in logistics companies. Through targeted document tracing and strategic income alignment, we ensure clean audit trails — preserving business continuity and avoiding reputational risk.

Interested to get more services information?