Join our Affiliate Transfer Pricing Program & Partner with a former LHDN officer

To Deliver “accurate”, “Effectivity” “compliant” transfer pricing Services For all client

What is

Transfer Pricing

In today’s highly regulated tax environment, partnering with an accounting firm that specialises in transfer pricing is essential. Such firms ensure full compliance with Malaysia’s transfer pricing requirements, uphold the arm’s length principle, and provide robust documentation to withstand tax audits. Beyond regulatory compliance, they offer strategic insights that enhance tax efficiency, strengthen transparency, and support sustainable business growth across borders.

Expand Your Customer Base with

Transfer Pricing Affiliate Program

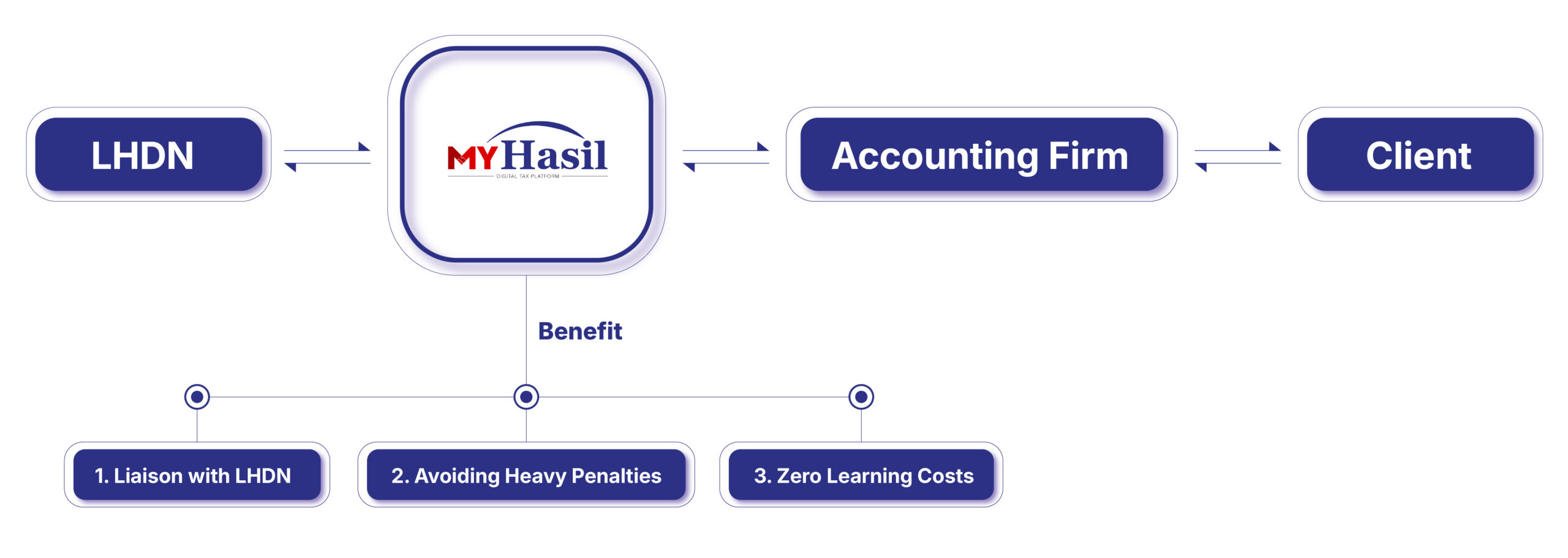

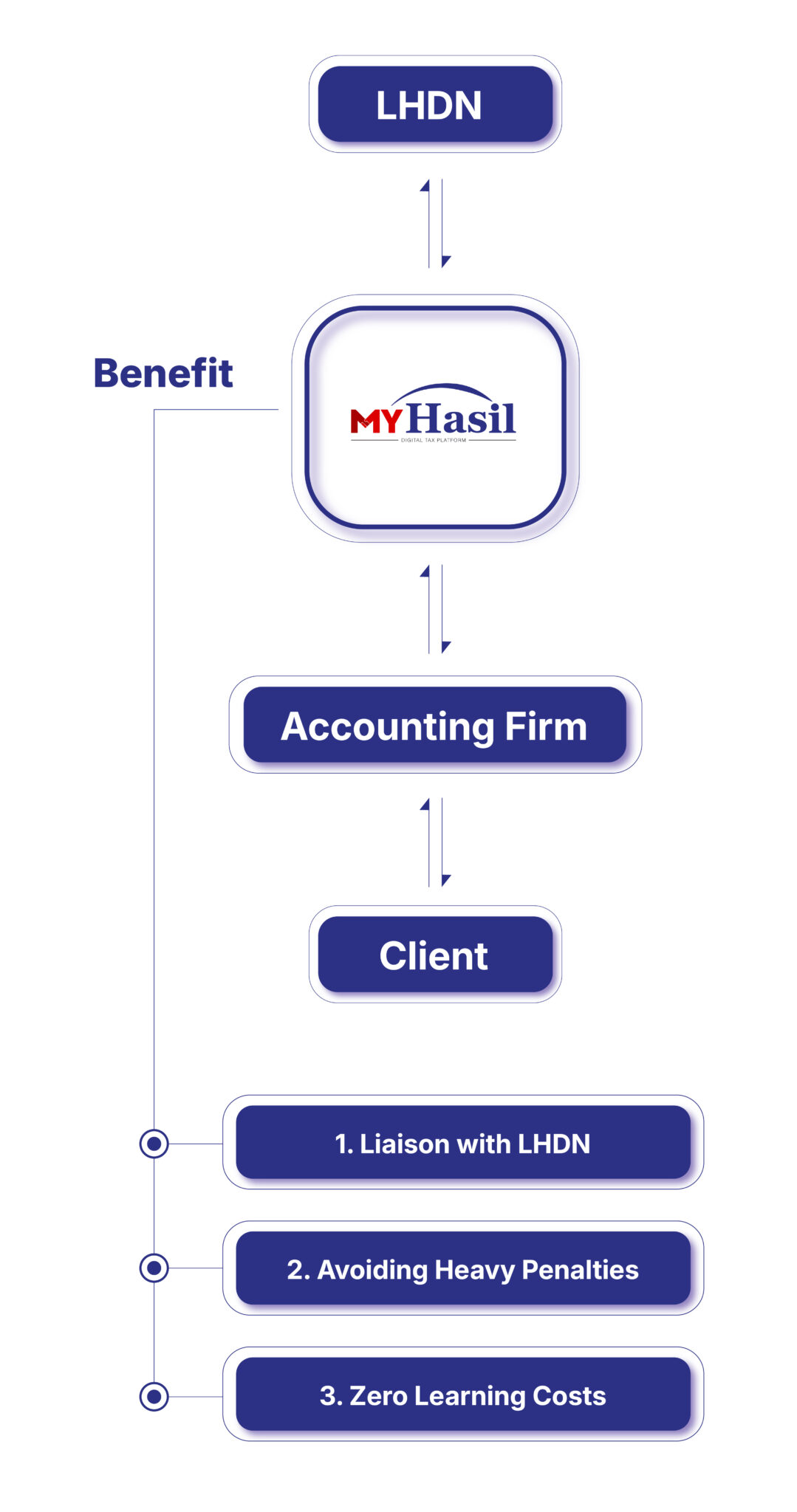

Led by a Former LHDN General Director, MyHasil revolutionizes transfer pricing with a cutting-edge digital tax platform powered by AI, expert collaboration, and unmatched efficiency, allowing accounting firms to deliver accurate, effective, and compliant services to clients with cost efficiency and hassle-free solutions.

Why Transfer Pricing Services Are

So Important for Accounting Firms?

TP Guidelines Strengthened

- LHDN revised its Transfer Pricing Guidelines, aligning with OECD standards.

- Mandatory TP documentation introduced for related-party transactions exceeding certain thresholds.

Increased Audit Activities

- LHDN began aggressively auditing TP cases, especially in cross-border or group transactions.

- Non-compliance led to adjustments, penalties, and public scrutiny.

SME Exposure Grows

- More SMEs started importing/exporting, setting up related companies, or receiving foreign funding.

- Many were unaware of TP obligations — but still subject to audits.

Enforcement Gets Smarter

- LHDN now uses data analytics and real-time matching to detect inconsistencies.

- Voluntary disclosure windows closed — exposure to full penalties increased.

Transfer Pricing Becomes Essential

- Firms that fail to offer TP services risk losing clients to larger or better-equipped firms.

- White-label TP support allows small and mid-sized firms to offer expert services without hiring full-time TP staff.

Unlock Huge Potential For Your Firm

Transfer Pricing involves complex documentation, benchmarking, and understanding LHDN enforcement trends. Few firms have the in-house expertise to handle this confidently.

Prepared by former IRB officers and advice on Master File, Local File, Country-by-Country Report to Ensure compliance with Regulation

Offering TP services shifts a firm from routine compliance to strategic advisory. It deepens trust, unlocks higher billing rates, and increases total profit per client.

Adding TP services positions the firm as a full-service advisor, capable of serving larger businesses and group structures — a key step to scaling up.

Many multinational clients require local TP specialists for Malaysian compliance. Firms offering credible TP services gain access to MNC engagements, regional referrals, and cross-border collaborations

Our Comprehensive Transfer Pricing(TP) Services

All reports are prepared by former IRB officers experienced in the knowledge, administration, and operations of transfer pricing

Create inter-company agreements with clear scopes of work, acceptable formulas based on LHDN requirements, and transfer pricing clauses to ensure compliance with Malaysian law

We can help with:

- Drafting and reviewing inter-company agreements

- Ensuring compliance with LHDN requirements

- Defining scopes of work and pricing formulas

- Adding transfer pricing clauses

Prepared by former IRB officers and advice on Master File, Local File, Country-by-Country Report to ensure compliance with Regulation.

We can help with:

- Preparing Master File, Local File & CbCR

- Reviewing documents for full compliance

- Identifying and fixing documentation gaps

- Supporting during TP review or audit

Expert guidance on cross-border transactions and structuring by analyzing international tax laws, identifying opportunities for tax optimization, and designing strategies to enhance tax efficiency and compliance.

We can help with:

- Analyzing international tax structures

- Advising on Double Tax Agreements (DTA)

- Optimizing cross-border arrangements

- Designing compliant, tax-efficient strategies

Developing and refining transfer pricing policies and strategies by analyzing your business operations, aligning with regulatory requirements, and implementing optimization techniques to enhance tax efficiency and minimize risk.

We can help with:

- Reviewing existing TP policies

- Developing customized TP strategies

- Identifying optimization opportunities

- Minimizing compliance risks

Representation and expert support during tax audits and disputes, handling case preparation, negotiations with tax authorities, and advocacy.

We can help with:

- Preparing audit documentation

- Communicating with LHDN officers

- Managing disputes and negotiations

- Providing post-audit advisory

Stay informed on the latest developments in transfer pricing laws. Provide the most current and relevant advice.

We can help with:

- Monitoring new TP regulations

- Updating policies for compliance

- Sharing latest insights and best practices

- Providing regular TP updates

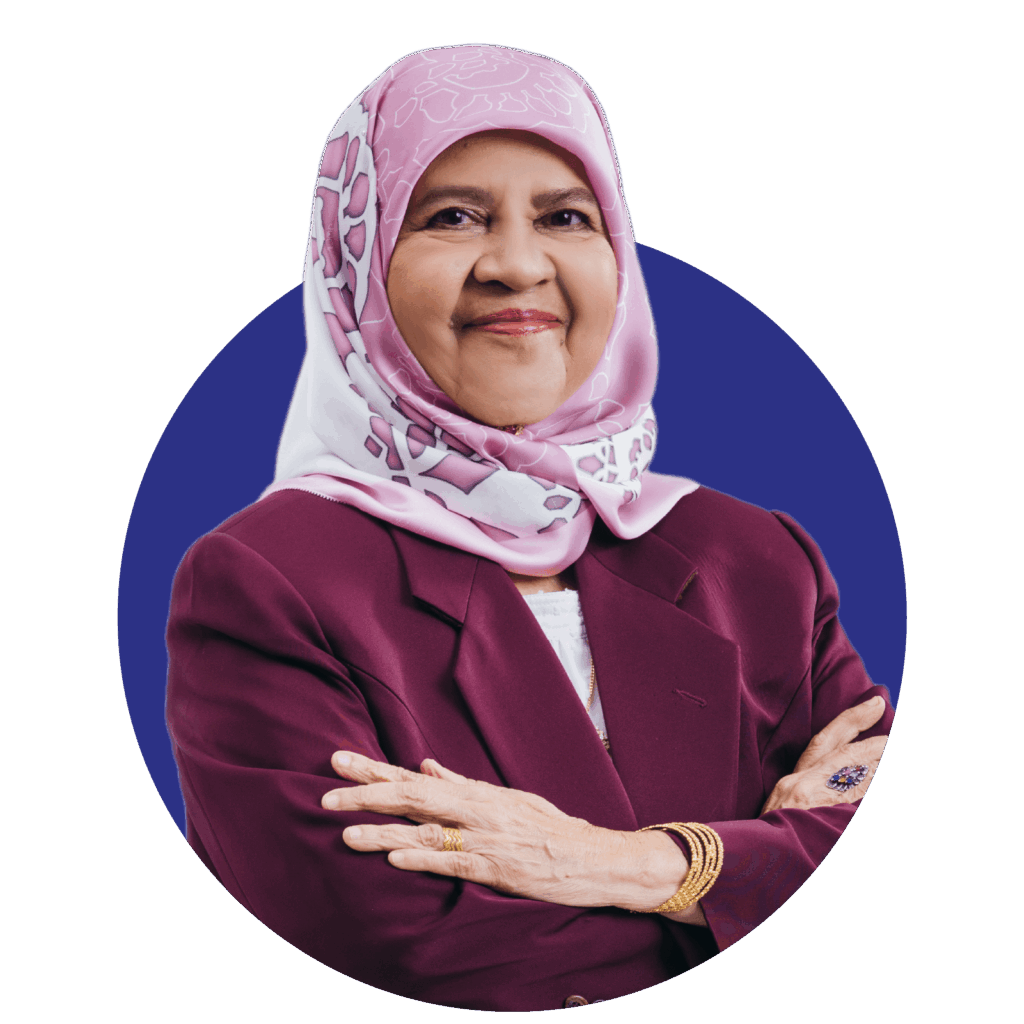

Our Team

Tan Sri Hasmah Binti Abdullah

Lead by former DG/LHDNM CEO

Dato’ Seri Mohd Nizom Bin Sairi

Lead by former DG/LHDNM CEO

Datuk Najirah Binti Mohd Tassaduk Khan

Lead by former DG/LHDNM CEO

Interested to get more services information?